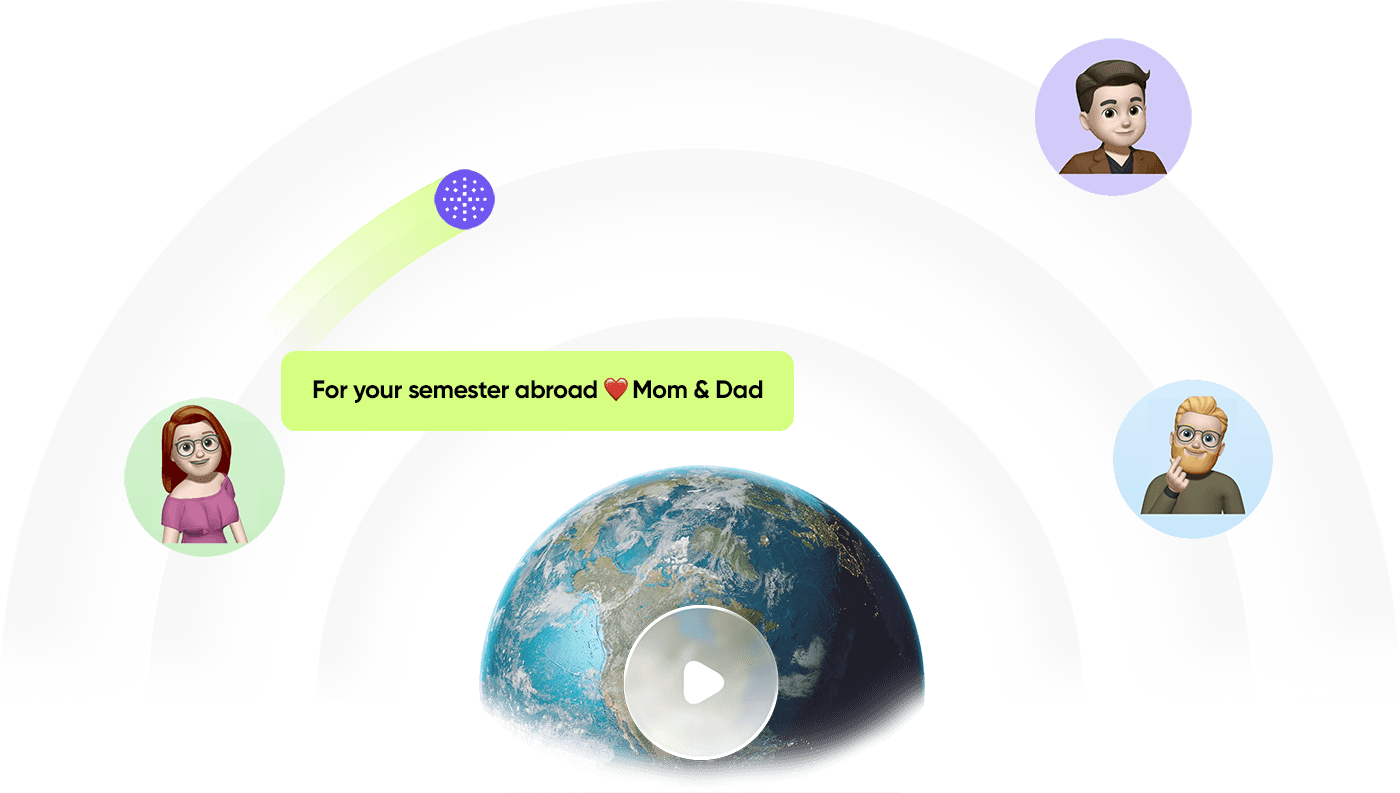

Big life moments, moved in seconds.

From tuition and rent to everyday support, Firma moves money for family and friends globally—without the delays and fees of traditional banks.

Fall semester tuition · Switzerland

Banks Stall.

Firma 🛞️️ Moves.

Banks, payment processors and money transfer apps work against you. High fees. Slow transfers. No control.At Firma, we believe money should move freely and cost less.So we flip the script: instant payments, zero fees, and true self-custody — all operated securely out of Switzerland.Firma is banking that doesn't suck.

How Compares To

Compares To

| Metric | Competitor | Firma |

|---|---|---|

| Transaction fees | — | 0% |

| Settlement time | — | < 3 seconds |

| FX / currency fees | — | 0% |

| Non-custodial | — | Yes |

| Onboard time | — | < 10 seconds |

| Origin | — | Switzerland |

Why Choose  Firma?Why Choose

Firma?Why Choose Firma?

Firma?

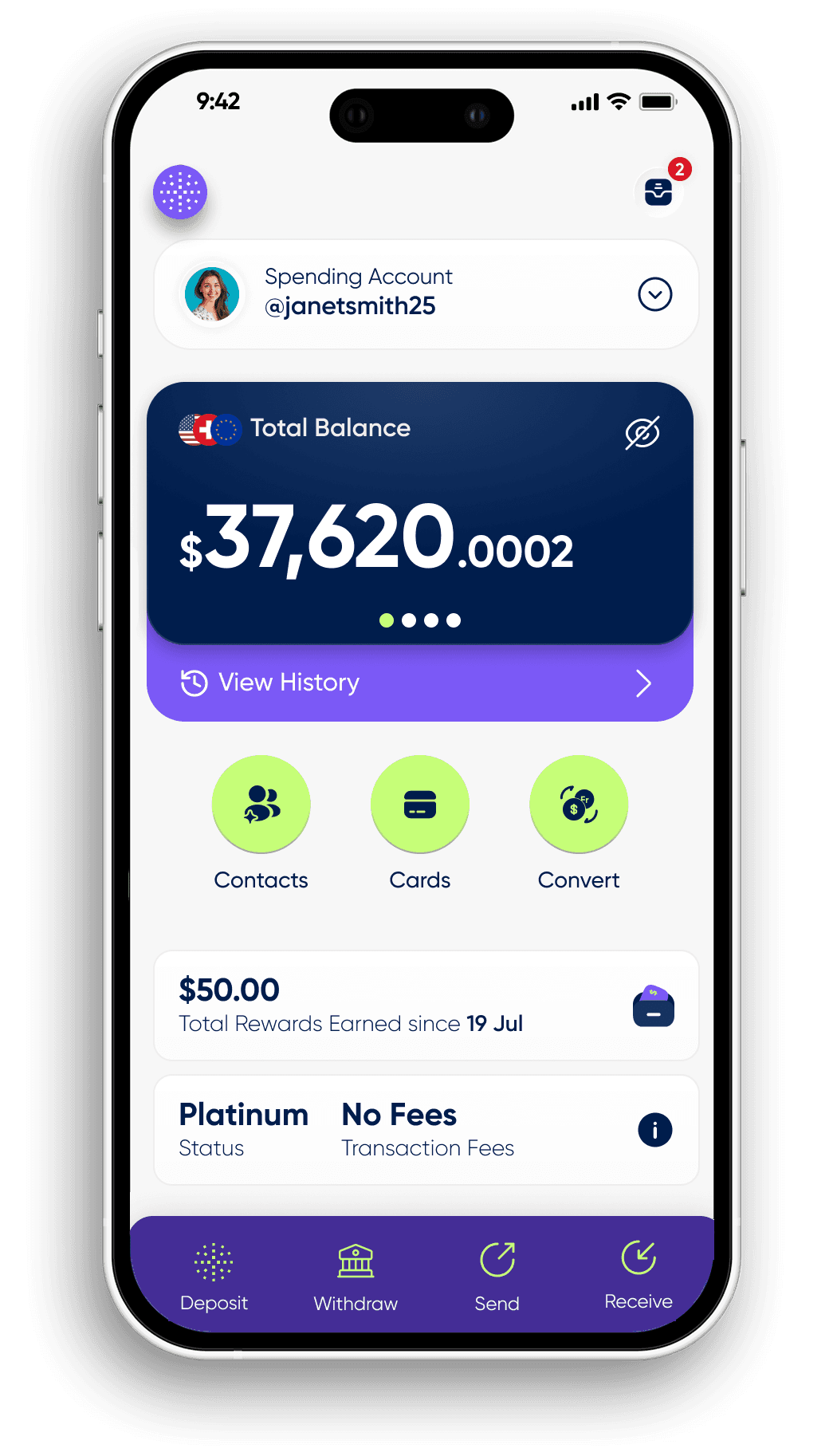

⚡ Lightning-Fast Payments

Spend your cash instantly. Arrives in a second and final settlement in two. No holds, waiting-times or lock-ups.

⛽️ No Transaction Fees, Ever.

Never pay a cent to send or receive your hard-earned money. Keep every dollar, franc or euro that's yours.

No Payment Processing Fees

Businesses save up to 5% of their revenue and get paid instantly. No wait times to access your money.

Apple or Google Passkey

Stored securely using Face ID or Touch ID

🔒 Truly Non-Custodial

Your funds are under your control. Protected by encryption, stored as a passkey on your device, or 12 word password.

How It Works💡

Pay Anyone, Anywhere

No wait times or transaction fees.

Send money via text, Whatsapp, Telegram or email, even if they don't yet have a Firma account.

You received $250.00

from Jenna

My share of the Airbnb 🏠

Get Paid Instantly

Payments clear in under three seconds.

Perfect for family, friends, freelancers, and businesses.

Store Global Currencies

Firma USD, CHF, Euro and more.

Organize Your Money

Trips, rainy days and everyday life.

Savings, spending, goals — each in their own place.

Trusted.

Transparent.

Always 1:1.